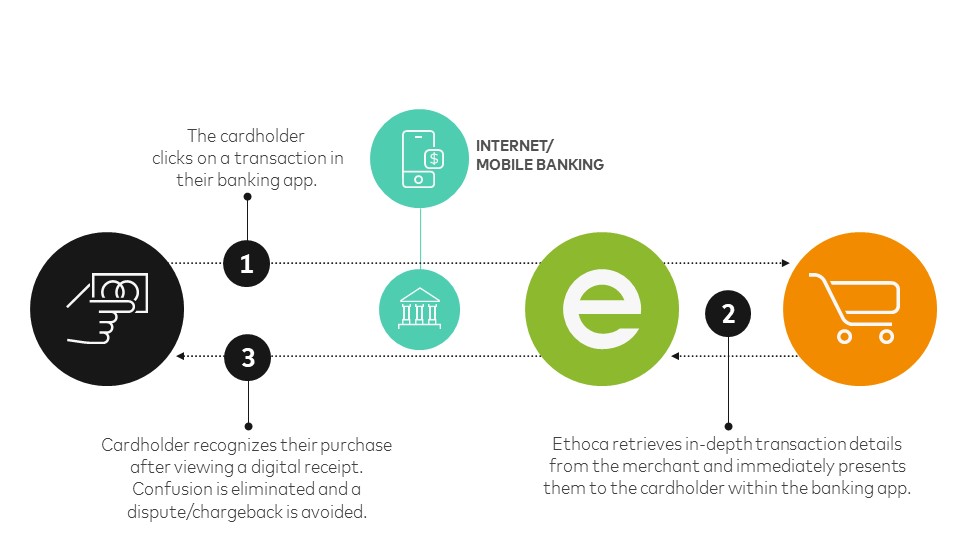

Ethoca Consumer ClarityTM makes it easier for issuers to bring new digital banking features to life - including clear merchant names, logos, itemized digital receipts and subscription controls - in both digital banking and call center channels.

Build a digital banking experience that creates more meaningful connection with your cardholders.

Avoid unnecessary chargebacks and write-offs by reducing confusion that often leads to disputes.

Make it easier for your call center teams to resolve customer inquiries quickly - reducing call times and volume.

Improve key KPIs like average first call resolution and CSAT scores.

Subscription Controls enables issuers to provide their cardholders more insight and control over their subscription payments — improving the customer experience while also helping avoid write-offs and chargebacks.

Subscription Controls is available on our versionless API which makes it easy for issuers to bring subscription controls functionality to life in their banking channels.

Contact us today to learn more about how Consumer Clarity can enhance your banking operations to deliver an experience your customers will love, while also reducing disputes and chargebacks.

© 2024 Ethoca. All rights reserved.

© 2024 Mastercard. All rights reserved.

Mastercard is a registered trademark, and the circles design is a trademark, of Mastercard International Incorporated.